Trading or investing, a synthetic analysis of these activities with a clear explanation, some very useful quotes, and finally also some common mistakes to avoid.

As Morgan Housel said, there are 56,956 personal finance books on Amazon.com. In aggregate, they contain more than 3 billion words. This seems absurd, because 99% of personal finance can be summarized in nine words: Work a lot, spend a little, invest the difference. Master that, and the other 2.999 billion words are filler.

Therefore the most important finance topics don’t require details. Most can be, and should be, summarized in a sentence or two. So, before my article about the pros and cons of trading I post ten sentences by the author of The Psychology of Money and Same as ever, to give the readers some good advices.

The most powerful way to grow your money is learning to live with less, since you have complete control over it.

Morgan Housel

You can probably afford not to be a great investor – you probably can’t afford to be a bad one.

Morgan Housel

Be careful when reading about how stupid investors can be and not realize you’re reading about yourself.

Morgan Housel

Your circle of competence is probably 90% smaller than you think it is.

Morgan Housel

Emotional intelligence is more important than book intelligence.

Morgan Housel

The more you learn about the economy, the more you realize you have no idea what’s going on.

Morgan Housel

Assume the worst, hope for the best, accept reality.

Morgan Housel

Investors were probably better informed 20 years ago when there was 90% less financial news.

Morgan Housel

Holding 60% of your assets in stocks and 40% in bonds isn’t perfect for everyone; but I can think of a thousand worse strategies.

Morgan Housel

Respect the role luck has played on some of your role models.

Morgan Housel

Trading Versus Investing

The debate on stocks trading presented valid arguments from both sides. We can highlight the potential for wealth accumulation and growth through stock trading, emphasizing the importance of research and diversification to mitigate risks. On the other hand, we have to consider some concerns about the inherent volatility and unpredictability of the stock market, warning against potential financial losses. In this case, the cautious approach of common sense seems more prudent, given the significant risks involved in stock trading. Anyway, before reading the post never forget that past performance does not guarantee or predict future ones.

Trading and investing are both ways of participating in financial markets, but they differ significantly in terms of their objectives, time horizons, strategies, and risk profiles. Overall, while both trading and investing involve participating in financial markets, they differ in their objectives, time horizons, strategies, and risk profiles. Traders seek to profit from short-term price movements, while investors focus on long-term wealth accumulation.

The primary objective of trading is to profit from short-term price fluctuations. Trading involves higher levels of risk due to the short-term nature of transactions and frequent trading activity. Traders are exposed to market volatility, liquidity risk, and leverage risk. The potential for both significant gains and losses is higher in trading. It is an activity that requires active involvement in monitoring markets, analyzing data, and executing trades. Traders need to stay updated on market news, economic indicators, and company developments to make informed decisions.

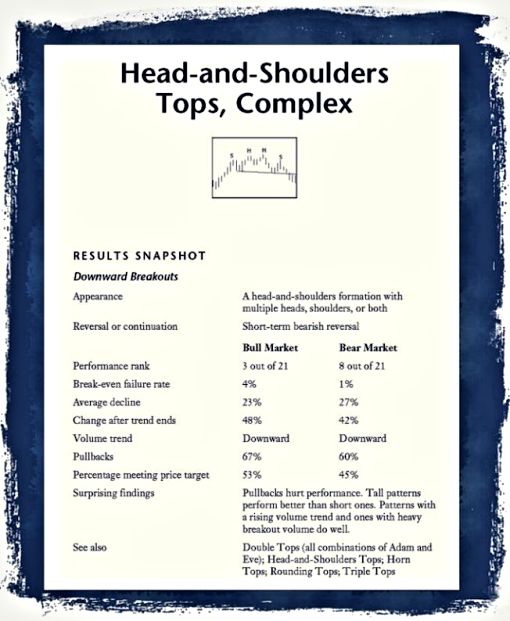

Traders typically buy and sell assets within a relatively short time frame, ranging from seconds to months. They usually has a short-term time horizon and may hold positions for a few minutes, hours, or days, trying to capitalize on short-term price movements and market inefficiencies. Traders use various strategies, such as technical analysis, fundamental analysis, and algorithmic trading, to identify short-term trading opportunities. They may employ leverage and derivatives to amplify returns or hedge risk.

On the contrary Investing focuses on building wealth over the long term. Investors aim to generate returns through asset appreciation, dividends, and interest income over a period of years or decades. Investing is generally considered less risky compared to trading because it’s based on a long-term view of the market. Investors may experience fluctuations in the value of their investments but are more focused on the overall growth trajectory of their portfolios. Investing is generally considered less risky compared to trading because it’s based on a long-term view of the market. Investors may experience fluctuations in the value of their investments but are more focused on the overall growth trajectory of their portfolios.

Investing requires less active involvement as investors typically adopt a buy-and-hold approach. They may periodically review their portfolios and make adjustments based on changes in their financial goals or market conditions. Investors have a long-term time horizon and are willing to hold assets for years or even decades. They aim to benefit from the long-term growth potential of their investments. They focus on fundamental analysis and research to identify undervalued assets with strong growth potential. They typically adopt a buy-and-hold strategy and may diversify their portfolios across different asset classes.

Investing in stocks trading provides individuals with the opportunity to grow their wealth and achieve financial independence. It allows for participation in the success of companies and the broader economy, leading to potential higher returns compared to traditional savings methods.

While it is true that stocks trading carries risks, it also offers the potential for long-term growth and wealth accumulation. By diversifying their investments and conducting thorough research, individuals can mitigate some of the risks associated with the stock market. Additionally, historical data shows that, over the long term, the stock market tends to provide higher returns compared to other forms of investment.

While it’s important to educate individuals about the risks of stock trading, dismissing it altogether would mean missing out on the potential rewards it can bring. With proper risk management strategies, such as setting stop-loss orders and having a diversified portfolio, investors can navigate the ups and downs of the market. It’s essential to strike a balance between risk and reward to make informed investment decisions.

Trading offers the potential for significant profits if done correctly. Traders can capitalize on price movements to make money. In many markets, there’s high liquidity, meaning assets can be bought and sold quickly without significantly impacting their prices. Furthermore with advancements in technology, trading has become increasingly accessible to individuals. Online trading platforms and mobile apps make it easier than ever to participate in markets.

Trading allows investors to diversify their portfolios, spreading risk across different assets and markets. Traders have the flexibility to choose their strategies, timeframes, and assets, allowing them to tailor their approach to their goals and risk tolerance. What’s more Trading can be used as a hedging tool to mitigate risks associated with other investments. For example, futures contracts can be used to hedge against price fluctuations.

Isn’t it true that stocks trading is inherently risky and speculative? The volatility of the market can lead to significant losses, especially for inexperienced investors. Many people have lost substantial amounts of money in the stock market due to unforeseen events or market fluctuations. How can you justify encouraging individuals to take on such risks?

However, the unpredictability of the stock market makes it inherently risky, even for seasoned investors. Market crashes and economic downturns can wipe out years of gains in a matter of days. Encouraging individuals to engage in stocks trading without fully understanding the risks involved can lead to financial ruin. Shouldn’t we be promoting more stable and secure investment options to safeguard people’s financial well-being?

Trading involves inherent risks, and there’s always the possibility of losing money. Markets can be volatile and unpredictable, leading to unexpected losses. Emotional decision-making can negatively affect trading outcomes. Fear, greed, and overconfidence can lead to impulsive decisions and losses.

Successful trading requires time, effort, and continuous learning. It’s not a passive activity and can be time-consuming, especially for active traders. Trading often involves various costs, including commissions, spreads, and other fees. These costs can eat into profits, especially for frequent traders. This activity is subject to regulatory oversight, and changes in regulations can impact market dynamics and trading strategies.

With the abundance of information available, it can be challenging for traders to filter out noise and focus on relevant data. This can lead to analysis paralysis and decision-making errors. In some markets, there may be instances of market manipulation or insider trading, posing risks to traders.

It’s essential for traders to carefully consider these factors and develop a clear trading plan that aligns with their financial goals and risk tolerance. Additionally, risk management strategies, such as setting stop-loss orders and diversifying portfolios, can help mitigate some of the disadvantages associated with trading.

In conclusion, despite what many believe, trading is not a get-rich-quick scheme. It requires numerous hours of study, practice, and discipline, and even then, success is not guaranteed. Every trader, no matter their expertise level, has made mistakes throughout their trading experience. However, some mistakes can be more costly than others and can ultimately lead to blowing up an account. So, to end this article I am going to list 10 trading mistakes that traders make and how to avoid them.

1) Not researching the markets well: Avoid making trading decisions based on gut feelings or tips alone. Conduct thorough market research to understand factors such as market volatility, stability, and current trends before opening or closing a position.

2) Not trading with a plan: Develop a comprehensive trading plan that includes your strategy, time commitments, and investment capital. Stick to your plan even after a bad day, as it serves as a blueprint for your trading activities. Maintain a trading diary to track successful and unsuccessful trades, helping you learn from mistakes and make better decisions.

3) Over-relying on software: While trading software can be beneficial, understand its pros and cons. Algorithmic trading systems offer speed but lack human judgement. Be cautious of potential risks, such as market flash crashes caused by automated system reactions. Combine the benefits of software with your own market analysis and decision-making skills.

4) Failing to cut losses: Resist the temptation to hold onto losing trades in hopes of a market turnaround. Cut losses by setting predetermined stop loss or limits to minimise risks. Day traders should close all active positions by the end of the trading day to avoid prolonged negative impacts.

5) Overexposing a position: Avoid committing excessive capital to a single market, as it increases inherent risk. While higher exposure may lead to larger gains, it also amplifies potential losses. Maintain a balanced approach and consider diversifying your portfolio.

6) Over-diversifying a portfolio too fast: Diversification could protect against declines in specific assets but be mindful of opening too many positions within a short timeframe. Managing a diverse portfolio requires more time and effort, keeping track of various market factors. Find a balance between diversification and manageable workload, especially for beginners or those with limited time.

7) Not understanding leverage: Leverage allows traders to gain exposure to larger positions with a smaller deposit. However, it amplifies both gains and losses. Fully comprehend the implications of leveraged trading before entering positions. Lack of understanding it could lead to substantial losses or even deplete your trading account.

8) Not understanding the risk-to-reward ratio: The risk-to-reward ratio is a crucial concept in trading that helps traders evaluate whether the potential profit justifies the risk of losing capital. It is important to consider this ratio before entering a trade. For example, if the risk-reward ratio is 1:2, it means that for every £1 you risk, you have the potential to make £2 in profit.

9) Overconfidence after a gain: Experiencing a profitable trade could evoke feelings of overconfidence, which could be detrimental to future trading decisions. Traders who become overconfident may ignore proper analysis and rush into new positions without considering market conditions or potential risks. To avoid falling into this trap, it is crucial to stay disciplined and stick to your trading plan.

10) Letting emotions impair decision-making: Emotional trading is considered a common pitfall in the financial markets. Emotions such as excitement, fear, or frustration can cloud judgement and lead to poor decision-making. Traders who let emotions dictate their actions may deviate from their trading plan, enter trades without proper analysis, or hold onto losing positions in the hope of a turnaround. To mitigate the impact of emotions on decision-making, it is essential to remain objective and adhere to a well-defined trading strategy. Base your trading decisions on thorough fundamental and technical analysis, rather than being influenced by temporary emotional fluctuations.

To find out more about trading and finance you can also read:

Jesse Livermore trading lessons

The true words of Jesse Livermore